Governance

Governance Goals

Healthcare Realty set meaningful long- and short-term goals that align with our ESG priorities. Our progress against these goals can be found in our annual Corporate Responsibility Report.

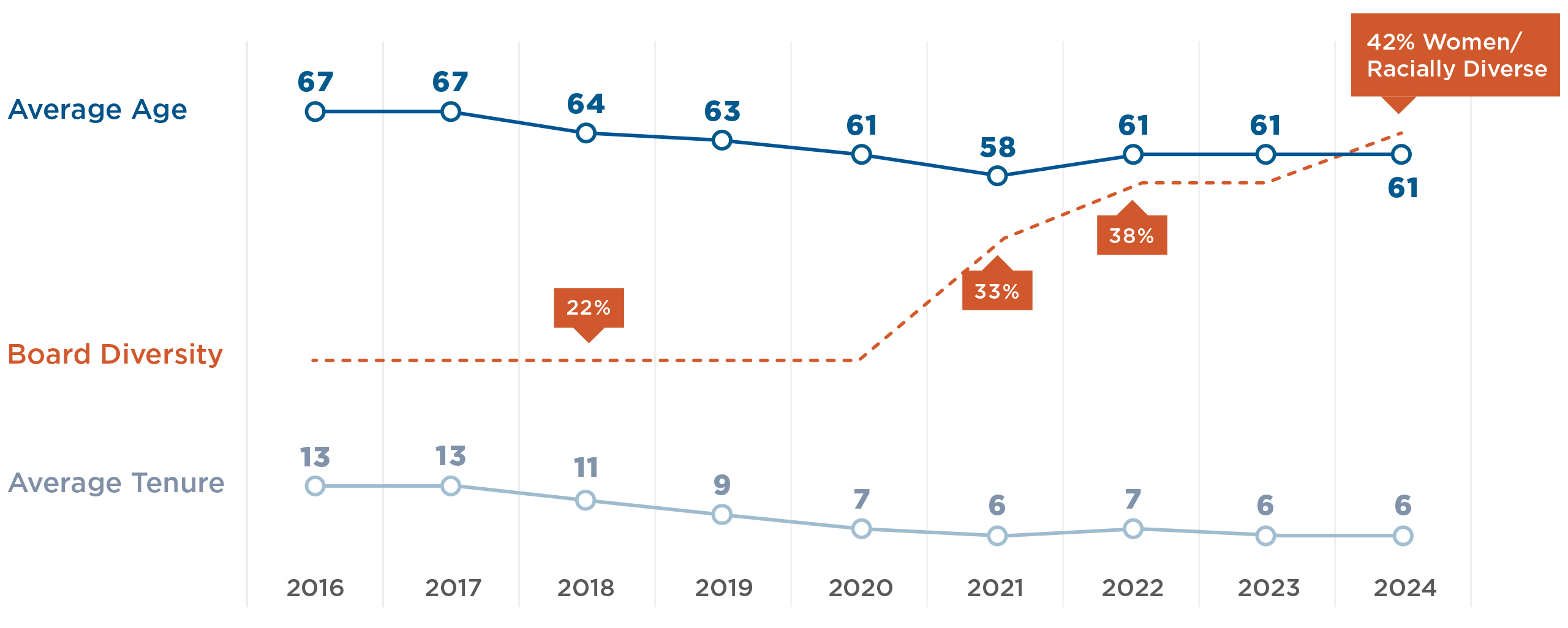

Maintain board diversity by having women and/or racially diverse representation for at least a third of the Board of Directors

100% employee participation in annual review of Code of Business Conduct

100% company participation in cybersecurity training

Maintain Institutional Shareholder Service (ISS) Prime Status

Governance Principles and Policies

- Annual board elections and director resignation policy if lacking a majority of votes

- Opted out of the MUTA, preventing the Company from staggering the board without shareholder approval

- Implemented “proxy access,” allowing eligible stockholders to include their own nominees for director in the Company’s proxy materials

- Anti-Hedging Policy applicable to all Company employees and directors

- Independent board chairman

- Annual “say-on-pay” vote by shareholders on the compensation of our Named Executive Officers (NEOs)

- Executive officer incentive compensation includes ESG performance components

- Stock ownership guidelines align the interests of the board, executive management, and shareholders

- No contributions to political campaigns or lobbying activities using Company funds

Board Diversity (1)

Healthcare Realty believes having a diverse and independent Board of Directors with different perspectives, backgrounds, and experiences contributes to the Company’s success.

In 2019, we set a goal to have at least one-third of our board members include women and/or people with racially diverse backgrounds by 2022. We achieved this goal in May 2021.

Board Transition

(1) Board of Director demographics are as of May 21, 2024.

ESG Oversight

Julie Wilson

Executive Vice President, Operations

Baker Thomas

Director, Corporate Responsibility

Management

Healthcare Realty’s ESG efforts are managed by our Executive Vice President, Operations, overseen by our Director of Corporate Responsibility, and supported by our Sustainability Analyst. The ESG team works with all departments to monitor progress on our ESG priorities.

BOARD OF DIRECTORS

Our Board of Directors believes integrating leading environmental, social, and governance practices in our culture, strategy, and operations is fundamental to the Company’s long-term growth. The Nominating and Corporate Governance Committee provides direct oversight of ESG initiatives, and the board receives quarterly updates on ESG matters.

ESG-Related Compensation

Healthcare Realty’s Executive Incentive Plan for named executive officers, which includes the Chief Executive Officer and four Executive Vice Presidents, includes a performance incentive based upon annual ESG objectives. ESG goals and initiatives for 2023 included(1):

- Monitoring, benchmarking, and reducing environmental resource use, including energy, water, solid waste, and greenhouse gas emissions

- Expansion and progress on social initiatives, including culture, employee engagement, turnover management, health and wellness, minority representation, tenant satisfaction, and charitable giving

- Enhancement and promotion of stakeholder engagement around ESG efforts