Environmental

Through data monitoring and strategic capital planning, we drive improved portfolio performance. Reducing utility costs – one of our largest operating expenses – has a significant impact on our sustainability practices. In turn, our tenants, health system partners, and shareholders benefit from cost savings and improved portfolio performance.

Environmental Goals

Healthcare Realty set meaningful long- and short-term goals that align with our ESG priorities. Our progress against these goals can be found in our annual Corporate Responsibility Report.

15% reduction in energy use by 2032 over a 2022 baseline

30% reduction in Scope 1 and 2 emissions by 2032 over a 2022 baseline

20% reduction in water use by 2032 over a 2022 baseline

Increase utility coverage to 90% by year-end 2024

Obtain green building certifications, including LEED, ENERGY STAR, IREM CSP for at least 11% of the portfolio by 2025.

Environmental Performance Highlights

In 2022, Healthcare Realty merged with HTA, substantially increasing our portfolio of medical outpatient buildings. In 2023, our teams worked to implement our data quality standards and data collection strategy across the portfolio, improving our data coverage to 71%.

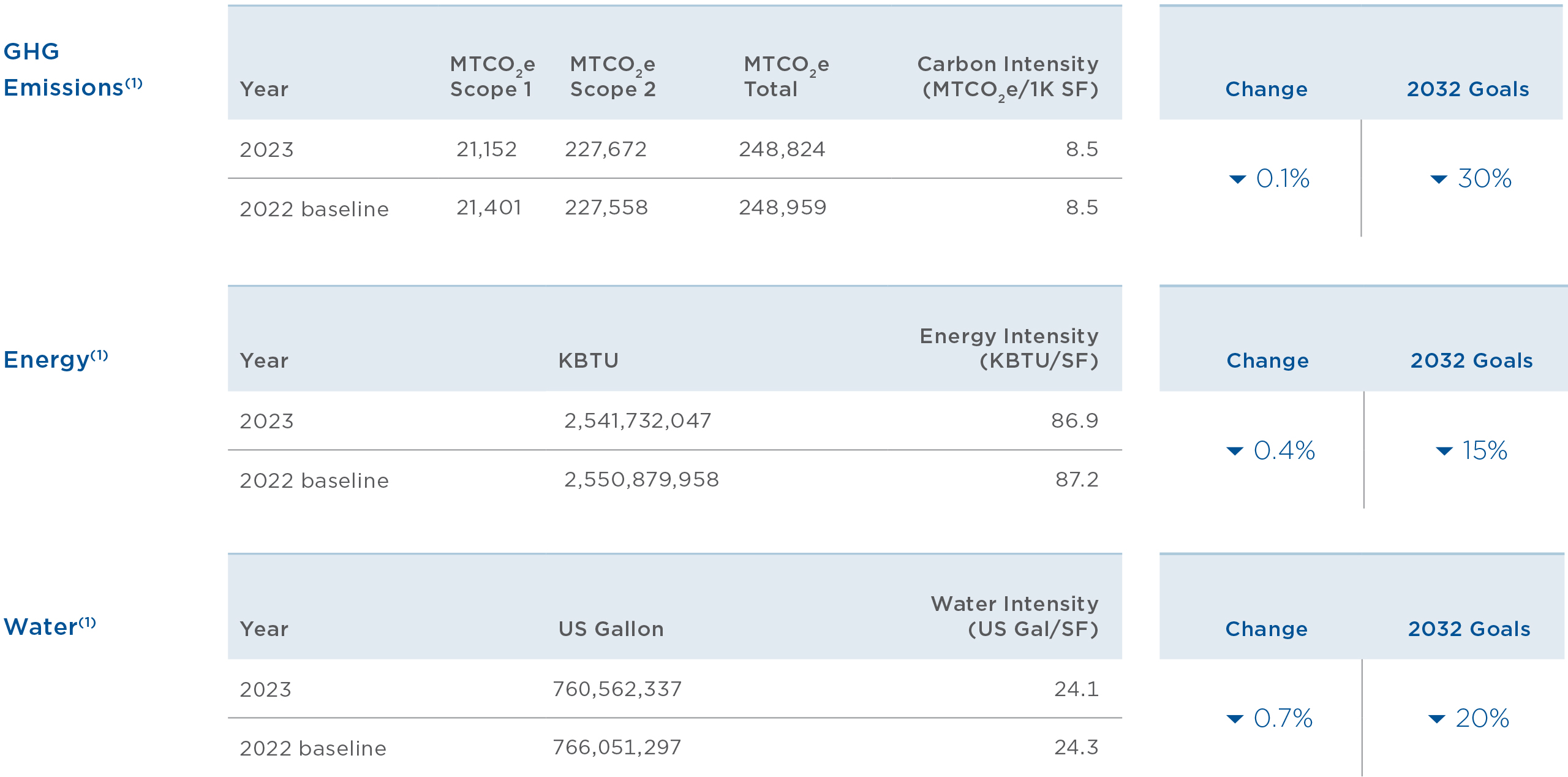

The following table highlights our environmental performance towards our newly established, ambitious energy, water, and GHG emissions goals.

Property Environmental Performance (1)

(Click the image to enlarge)

(1) This data includes properties owned by Healthcare Realty over which the Company holds operational control and where whole-building utility data was available for 2022 and 2023. Environmental performance for energy and GHG data includes 458 properties totaling 29.5M SF and water data includes 526 properties totaling 31.5M SF.

Green Building Certifications

Healthcare Realty continues to increase green buildings in our portfolio, targeting 11% portfolio coverage by 2025. In 2023, we obtained 57 green building certifications bringing our portfolio coverage to 8.3%. Obtaining these certifications ensures sustainability best practices are embedded at our properties.

(1) Five legacy HTA buildings (465K SF) with LEED certifications